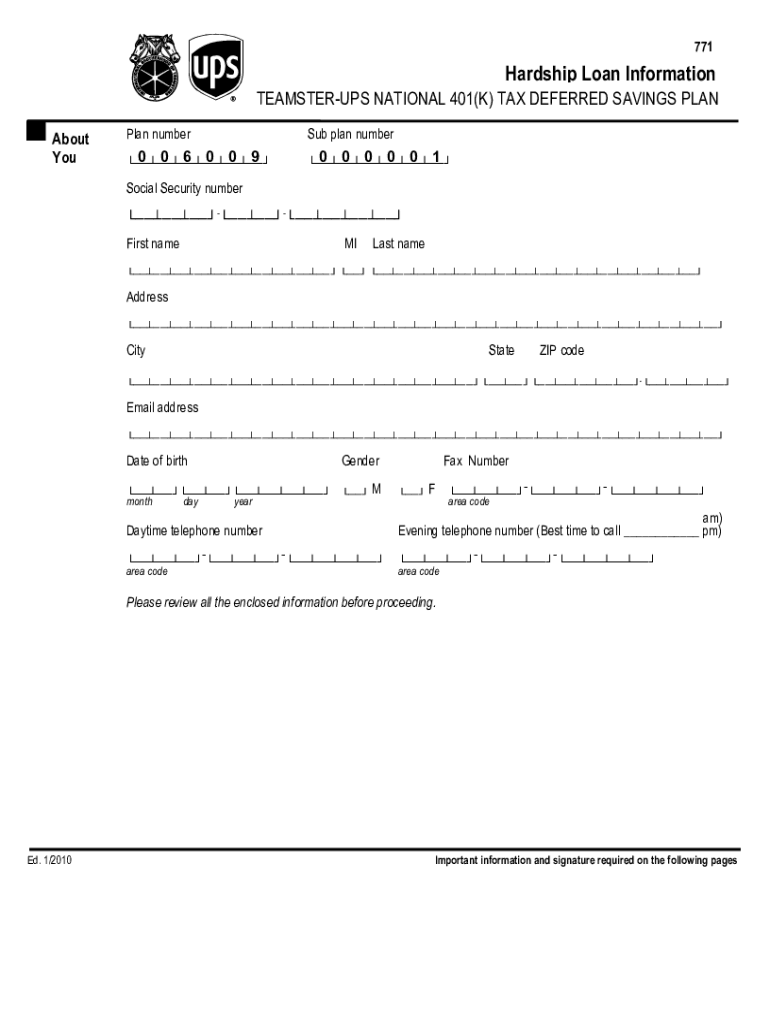

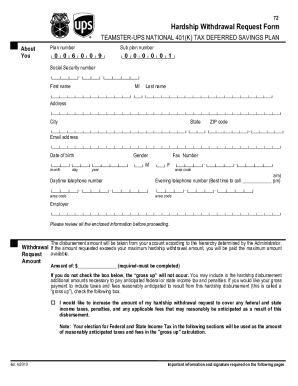

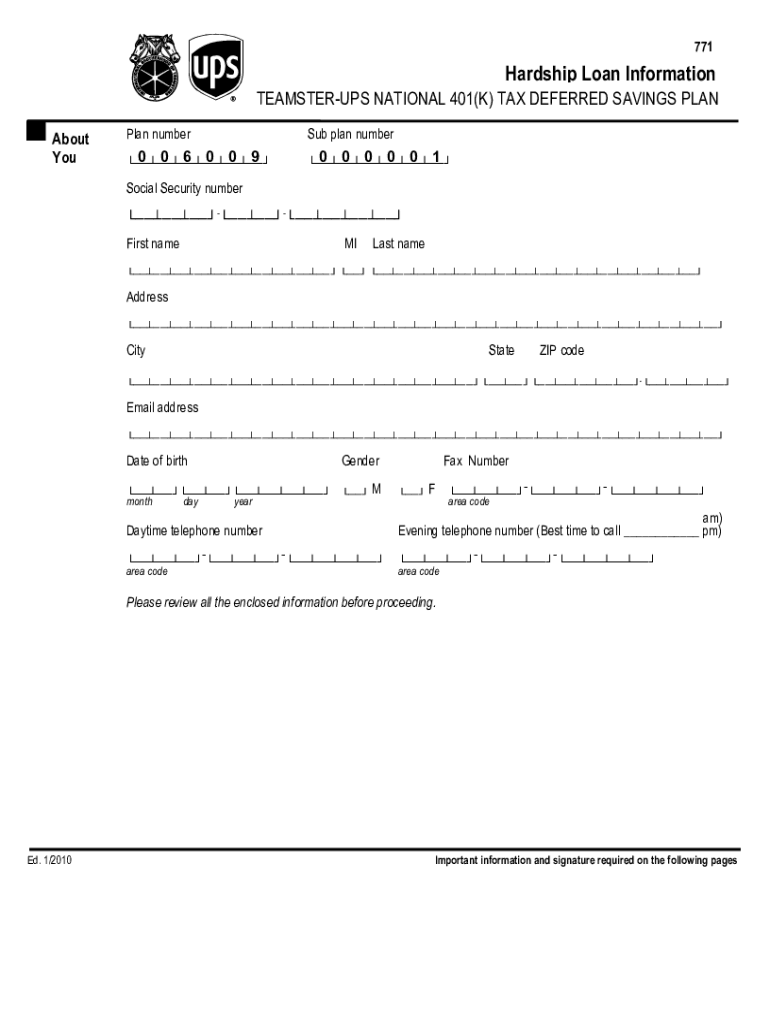

UPS Hardship Withdrawal Request Form 2010-2024 free printable template

Get, Create, Make and Sign

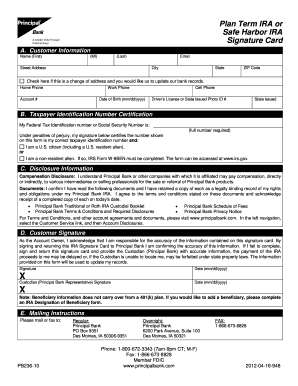

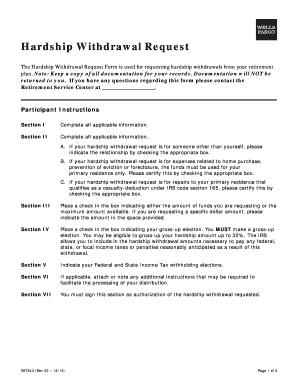

How to edit download paper work for a loan from prudential 401k online

How to fill out download paper work for

How to fill out prudential401k:

Who needs prudential401k:

Video instructions and help with filling out and completing download paper work for a loan from prudential 401k

Instructions and Help about prudential retirement loan form

I just wanted to share with you a little about my background because it might help you have little confidence that I kind of know what I'm talking about in this area also I'm celebrating 31 years with ups this year and I started in the Minnesota district as Trevor had mentioned I started as a preloader in the State Street building it doesn't exist anymore once they built Reagan and I actually was a pretty loader part-time while I was going to college and I loaded Jeff Human's truck Jeff didn't like me at first because young I didn't I was just throwing the packages in there and the first couple times he came back and wrote me up, and then I figured oh man I'm in trouble and as time went on I became much better and Jeff and I are actually friends today, and we would talk frequently his role as business agent, so I was it in the district I was a PRE loner for about four years what a driving bed down in the st. Paul building the State Street darling drove with Jeff drove with Brad Johnson and others that were in the State Street building I drove for a little over a year and then promoted into management spent most of my time in the district in the HR department hiring for the Minneapolis building the Reagan building I was an on road supervisor and West Center for a couple of years I worked in the st. Paul hub as a supervisor for a couple of years and then I was called down to corporate to work with the retirement group and I spent about a year and a half down in corporate working with retirement benefits for all the various plans that UPS has from there I was promoted and sent out to Philadelphia these central regions and I spent Scours actually in that area I worked in the region office in the HR group and I in the metro Philadelphia district and I worked over at the Philly air hub and that was a great experience Minnesota guy going out to the East Coast the first time my wife went to the grocery store she came home crying because when she put her groceries up on the counter they said come on hon we have to move this along got other people waiting we're here is oh how are you good day very nice people in Minnesota, but we enjoyed Philadelphia's great thing I was in Philadelphia for about six years, and then they transferred me down and promoted me to the district HR manager position in north Florida and that's in Jacksonville Florida I had two young daughters that were I think at the time nine and eleven, and they thought they won the lottery we're moving to Disney World and Jacksonville is about an hour and a half two hours from Disney World, but they enjoyed that, and they liked living in Florida so all of a sudden ups is working with the Teamsters through negotiations to try and get our ups arose out of central states and get a what we believe is a much better more secure pension plan, and they were working on those negotiations, and it was getting close and everybody was feeling very confident that they were going to get it done so my phone my...

Fill retirement form ups : Try Risk Free

People Also Ask about download paper work for a loan from prudential 401k

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your download paper work for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.